Managing customer credit is an important issue for each commercial bank; therefore, banks take great care when dealing with customer loans to avoid any improper decisions that can lead to loss of opportunity or financial losses. The manual estimation of customer creditworthiness has become both time- and resource-consuming. Moreover, a manual approach is subjective (dependable on the bank employee who gives this estimation), which is why devising and implementing programming models that provide loan estimations is the only way of eradicating the ‘human factor’ in this problem.

This model should give recommendations to the bank in terms of whether or not a loan should be given, or otherwise can give a probability in relation to whether the loan will be returned. Nowadays, a number of models have been designed, but there is no ideal classifier amongst these models since each gives some percentage of incorrect outputs; this is a critical consideration when each percent of an incorrect answer can mean millions of dollars of losses for large banks. However, the Logistic Regression remains the industry standard tool for credit-scoring models development. For this purpose, an investigation is carried out on the combination of the most efficient classifiers in credit-scoring scope in an attempt to produce a classifier that exceeds each of its classifiers or components.

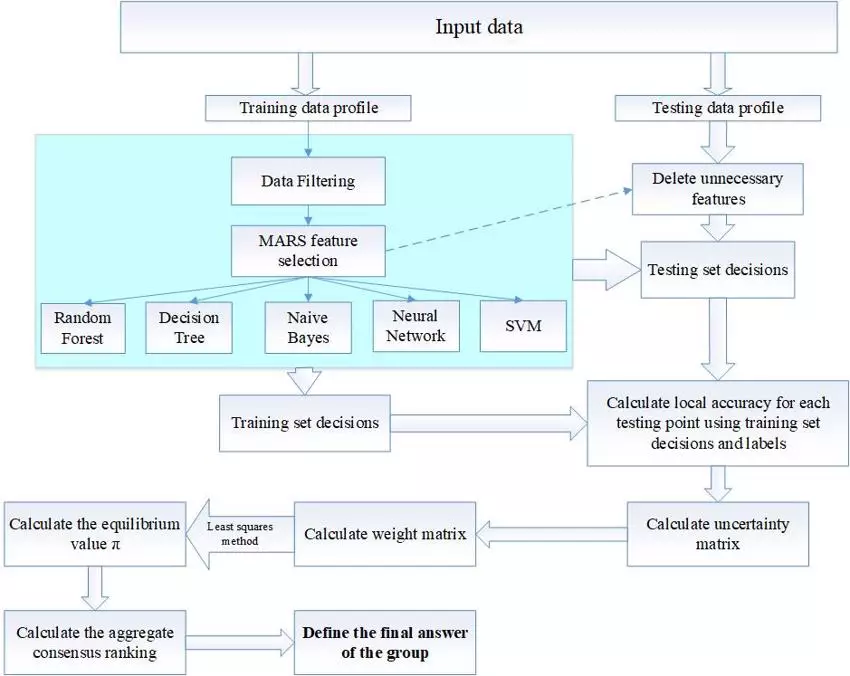

In this work, a fusion model referred to as ‘the Classifiers Consensus Approach’ is developed, which gives a lot better performance than each of the single classifiers that constitute it. The difference between the consensus approach and the majority of other combiners lies in the fact that the consensus approach adopts the model of real expert group behaviour during the process of finding the consensus (aggregate) answer. The consensus model is compared not only with single classifiers, but also with traditional combiners and a quite complex combiner model known as the ‘Dynamic Ensemble Selection’ approach.

A fusion model referred to as ‘the Classifiers Consensus Approach’

A fusion model referred to as ‘the Classifiers Consensus Approach’

Meet the Principal Investigator(s) for the project

Related Research Group(s)

AI Social and Digital Innovation - Social, economic and strategic effects of AI and associated technologies. Impact of AI and related technologies on societies, organisations and individuals.

Partnering with confidence

Organisations interested in our research can partner with us with confidence backed by an external and independent benchmark: The Knowledge Exchange Framework. Read more.

Project last modified 29/06/2021